Executive Summary

The next wave of automation isn't abstract AI models, it's general-purpose robots, increasingly humanoid in design, powered by mature sensors, chips, and actuation systems. These robots require immense backend infrastructure: not just AI models but dense compute, reliable motion control, and advanced sensors.

Why Now? Labor shortages, surging wages in logistics and manufacturing, and the rise of real-time AI inference have created a tipping point. Humanoid robots are leaving the lab and entering commercial deployment thanks to falling hardware costs and growing demand for scalable, general-purpose labor.

Rather than speculate on which humanoid form factor will win, we target upstream suppliers of compute, sensing, motion control, and component integration. These are the "bones and guts",essential in every robot, regardless of design.

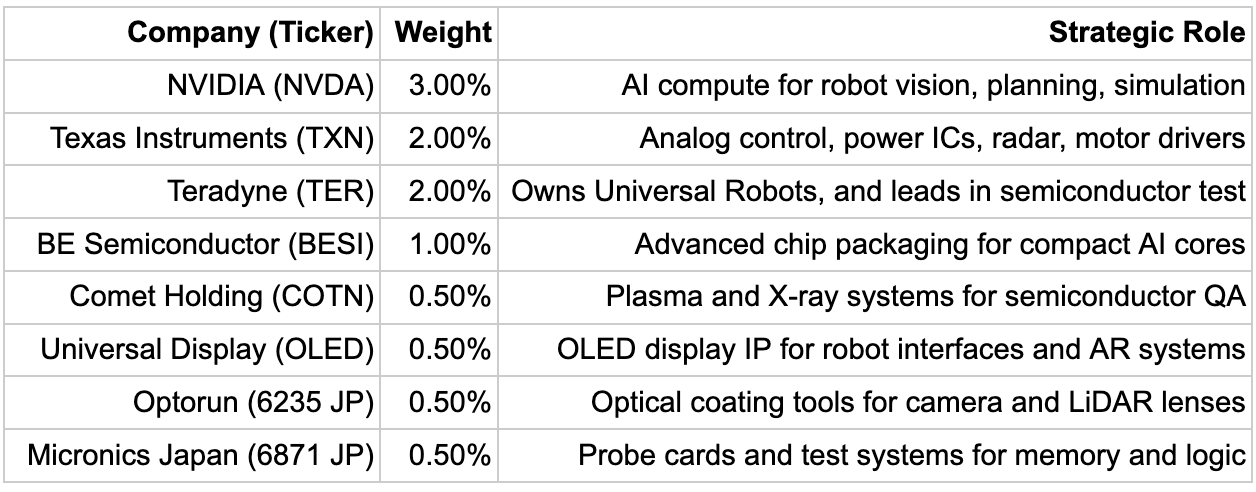

A 10% allocation to eight companies, weighted toward high-moat, high-margin players enabling the robotics stack. Each was selected based on durable competitive positioning, current product relevance, and exposure to the humanoid supply chain.

Basket Construction (10%)

Key Holdings Breakdown

NVIDIA (NVDA) – 3.0%

The Jetson AGX Orin module is central to NVIDIA's robotics platform, offering high-performance AI computing for edge devices.

Strategic Role: Acts as the cognitive engine of humanoid robots. NVIDIA’s GPUs and Jetson modules perform real-time AI inference for vision, decision-making, localization, and motion planning. Its Isaac robotics stack and Omniverse simulation tools allow developers to train and test robot behaviors at scale.

Moat: Deep integration across hardware and software. CUDA ecosystem makes switching prohibitively expensive for developers. Dominant AI accelerator share (~80%) and a lead in AI-capable robotics silicon (Jetson Orin, Thor). Also benefits from hyperscaler demand, providing financial strength to invest in longer-horizon robotics platforms.

Why It Wins: Every major humanoid robotics company, Apptronik, Figure, Sanctuary AI, builds on NVIDIA. Their Jetson Orin is now the industry default. Jensen Huang’s claim that "everything that moves will be autonomous" isn’t rhetoric, it’s a capital allocation roadmap. NVIDIA is building the full stack for physical AI.

Texas Instruments (TXN) – 2.0%

Texas Instruments leads the analog IC market, providing essential components for sensing and power management in robotics.

Strategic Role: TXN powers the sensing and motor control inside every robot limb, eye, and joint. It sells mmWave radar sensors, current-sense amplifiers, GaN power stages, and microcontrollers, all mission-critical for safe motion and environmental awareness.

Moat: Unmatched product breadth in analog and embedded semis, with an internal fab network and extreme customer loyalty due to design-in stickiness. Products remain in-market for decades. Its analog process R&D and manufacturing scale give it sustainable margin and pricing power.

Why It Wins: When Apptronik built Apollo, one of the most advanced humanoids to date, they used TXN to drive motors, handle real-time safety checks, and sense torque. These aren't generic parts, they're tuned for reliability and efficiency under extreme constraints. TXN will be in every serious robot that walks.

Teradyne (TER) – 2.0%

Strategic Role: Dual levered to robotics: (1) via Universal Robots and MiR, two of the most deployed automation platforms globally; and (2) through its dominance in chip test, every AI chip that powers a robot was likely verified on a Teradyne tester.

Moat: First-mover advantage in cobots, with deep integration and ecosystem (UR+). Semiconductor test tools are a duopoly (Teradyne + Advantest) due to deep engineering, long validation cycles, and strong IP in measurement software.

Why It Wins: UR arms are the first robots deployed in mid-size factories and labs due to safety, simplicity, and reliability. At the same time, as chip complexity increases with HBM and chiplets for robotics, test budgets rise, and Teradyne wins both ways.

BE Semiconductor (BESI) – 1.0%

New Wafer Level Assembly Technologies Extend Moore’s Law: 3D chiplets with hybrid bonding extend Moore's Law by increasing transistor density beyond traditional scaling limits. These methods stack silicon chiplets vertically with ultra-fine interconnects, enhancing performance and reducing interconnect length, which surpasses the enhancements achievable through traditional 2D scaling.

Strategic Role: BESI’s machines bond dies, stack memory, and encapsulate chips. These tools are how NVIDIA and others miniaturize compute for the edge, absolutely essential for mobile, battery-constrained robots.

Moat: 70% share in hybrid bonding tools, with key partnerships (TSMC, AMAT). High-margin, IP-intensive, process-critical systems. Switching costs are immense due to reliability and yield calibration.

Why It Wins: AI at the edge is useless if you can’t pack performance into low-weight, low-heat form factors. Robots don’t carry GPUs, they carry SoMs (System-on-Modules). BESI makes that physical integration possible.

Comet Holding (COTN) – 0.5%

Strategic Role: Supplies the RF plasma and X-ray imaging modules for fabs producing the chips and batteries inside robots. Without Comet, quality control of advanced robotics electronics would falter.

Moat: High voltage and RF specialization. Deep fab relationships and co-development projects (e.g. with Lam Research). Also dominant in niche high-res X-ray modules used in battery, PCB, and assembly inspection.

Why It Wins: With complexity rising in robot brains and battery systems, error tolerance is shrinking. Comet ensures each subsystem is safe, functional, and within spec, before it’s ever deployed in a robot.

Universal Display (OLED) – 0.5%

Strategic Role: Provides phosphorescent emitters used in OLED panels, these light up robot faces, dashboards, wearable displays, and AR devices used to train or monitor robots.

Moat: Sole licensor of phosphorescent OLED IP; essential emitter materials provider for every major OLED fab. Adding blue phosphorescent emitter in 2024 will complete its full RGB monopoly.

Why It Wins: As robots enter service environments (e.g. reception, logistics, healthcare), expressive displays become more important. OLED is the gold standard. UDC gets paid on every pixel, via license and materials.

Optorun (6235 JP) – 0.5%

Strategic Role: Sells coating machines that apply anti-reflective, IR-filtering, and hardened layers to lenses. This process is crucial for robot eyes, depth cameras, and LiDAR sensors.

Moat: 40%+ global share in thin-film deposition for optics. Proprietary recipe design and long-term relationships with lens OEMs in Japan, Korea, and Taiwan. Equipment is customized and tightly integrated.

Why It Wins: As robots need better visual acuity in more conditions, the sensors behind their cameras must improve. Optorun enables that through better optics manufacturing. It’s the quiet enabler behind every clear robotic eye.

Micronics Japan (6871 JP) – 0.5%

Strategic Role: Makes the probe cards that test memory, logic, and sensor chips at wafer-level. Their tools confirm functionality before anything is assembled into a robot.

Moat: Global leader in memory probe cards. Precision engineering and customer validation cycles lock in share. R&D driven, with expansion into advanced logic test for HBM and AI chiplets.

Why It Wins: Every robot that rolls off the line depends on chips that passed wafer-level testing. MJC sits right at the QA chokepoint, and earns recurring, high-margin revenue per chip volume.

Summary Table

As automation scales from warehouses to general-purpose humanoids, the companies enabling the skeleton, sensors, and silicon of this future stand to benefit. This basket is designed to capture the structural value-add without chasing hype.

Disclaimer:

Ridire Research is an independent content and research publication affiliated with Ridire Capital Management, a private investment adviser. The materials published herein, including explicit labels such as “Buy,” “Sell,” “Hold,” “Long,” or “Short”, are for general informational and educational purposes only. These views represent the author’s opinion based on publicly available information, internal research frameworks, and market analysis at the time of writing. They are not tailored to the specific investment objectives, financial situation, or risk tolerance of any individual investor.

Ridire Capital Management, its affiliates, and/or employees may hold, trade, or modify positions, long or short, in the securities mentioned, with no obligation to update disclosures or inform readers of changes. Any trade or allocation referenced should be viewed strictly in the context of a model portfolio and not as a solicitation or offer to buy or sell any security.

While all efforts are made to ensure factual accuracy and analytical rigor, no representation or warranty is made regarding the completeness, accuracy, or reliability of the information provided. Readers are urged to perform their own due diligence or consult with a licensed financial advisor before making any investment decisions. Past performance is not indicative of future results. Investing involves risk, including the risk of loss.