The Platform That Pays Everyone but You

Creator payouts, trust & safety costs, and minimal operating leverage, all while investors eat what's left.

Executive Summary

We are opening a short position in Roblox Corp (RBLX) in the model portfolio (-2% weight, ~15% stop loss target) based on persistent structural headwinds, heavy cost obligations, and a growth narrative that remains vulnerable to de-rating. While headline metrics for Q1 2025 superficially impressed, beating guidance on bookings and revenue, the composition of that growth reveals rising operational intensity, an unproven monetization shift towards older users, and continued dependence on user-generated content economics. The valuation still presumes platform-level defensibility and a long growth runway, yet the business model remains deeply exposed to genre cyclicality, cost creep, and demographic fragility.

Key Risks and Structural Headwinds

A. Bookings Growth Still Dependent on Emerging Markets and Youth Skew

Roblox posted Q1 bookings of $1.207B (+31% YoY), beating the top end of guidance ($1.15B), yet this strength was aided disproportionately by high-growth APAC markets such as India (+77% DAUs) and Japan (+48%). While impressive, these regions offer lower ARPU and greater FX volatility, making them unreliable engines for sustainable margin expansion. The U.S. and Canada showed solid 31% bookings growth, but Europe lagged in DAUs and hours, with Turkey still offline, indicating geographic inconsistency.

B. Demographic Aging-Up: Still Largely Aspirational

Management claims 62% of DAUs are now over 13, with that cohort growing +36% YoY. However, monetization within this segment remains unproven at scale. Despite genre expansion into RPG, racing, and battle formats, no material monetization metrics by cohort were provided. The platform’s historical monetization engine, children under 13, still underpins revenue, leaving aging-up more a narrative than a verified driver.

C. High Operating Leverage Without Margin Escape Velocity

While cash flow was strong (FCF $426M, +123% YoY), operating intensity remains high:

Developer Payouts (DevEx): $281M in Q1 (+39% YoY), equivalent to 27% of revenue and 23% of bookings.

Trust & Safety: $135M annualized (~13% of revenue), showing only 8% YoY growth, but still a high fixed burden scaling with user growth.

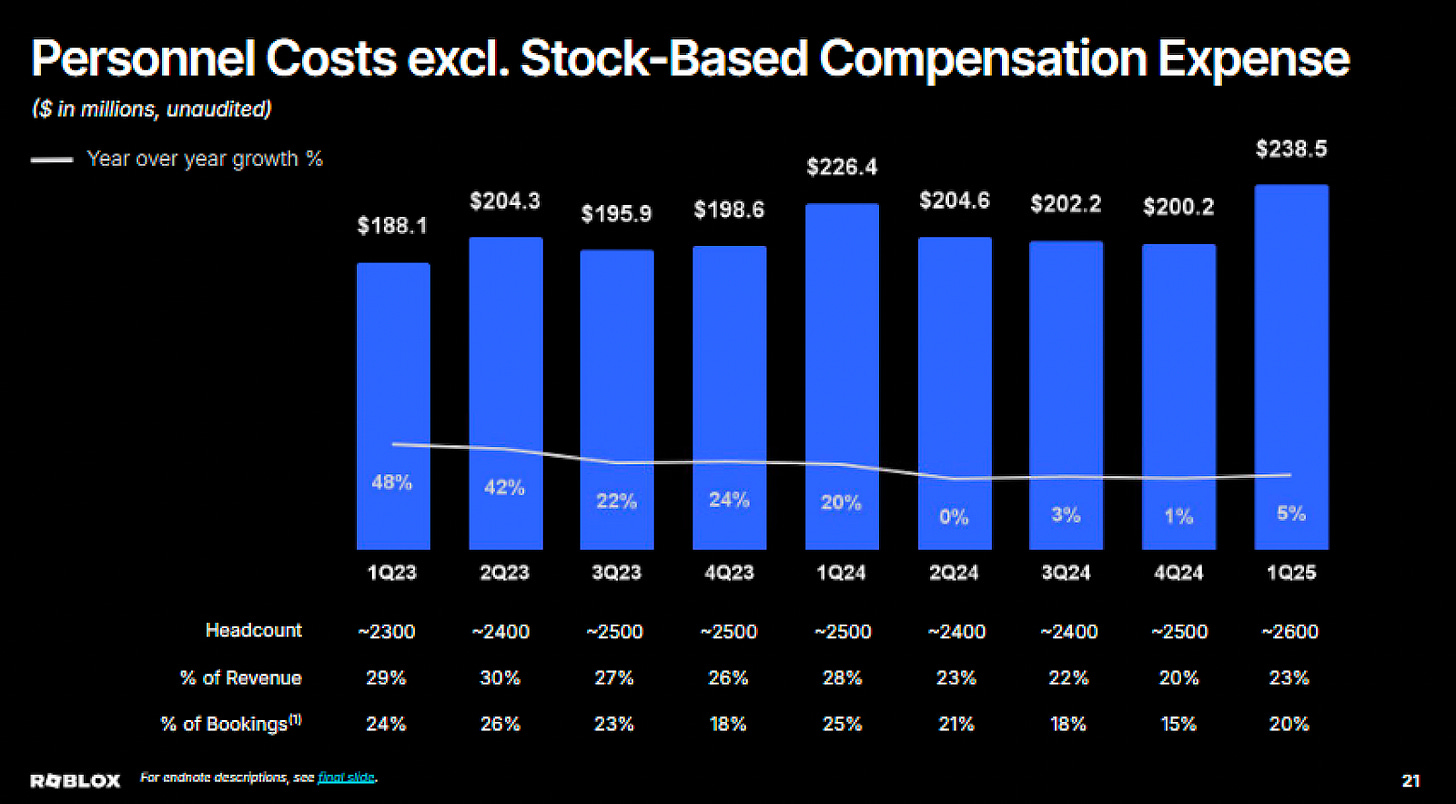

Personnel Costs (ex-SBC): $238M in Q1, or 23% of revenue, still outpacing efforts to reach meaningful operating leverage.

Even after aggressive efficiency improvements (notably AI-enhanced moderation), the path to sustainable EBITDA margin expansion remains clouded by the need to reinvest in safety, tooling, and infrastructure to preserve brand equity.

D. Advertising Still Immature; Other Monetization Levers Early Stage

While a Google ad integration is underway, management does not expect near-term revenue breakout and confirms ads are not currently material to bookings. Initiatives like regional pricing, in-experience price optimization, and direct payment arbitrage (e.g., Robux bonus via gift card) are conceptually sound but remain in early innings with unclear net margin impact. The Shopify integration and e-commerce monetization efforts are in the exploratory stage and do not yet factor into tangible revenue models.

E. Valuation Risk: High Expectations, Tight Narrative Bandwidth

Roblox continues to position itself as a platform capturing “10% of global gaming spend” and reaching “1 billion DAUs” over time. These goals underpin lofty valuation assumptions. However, such targets assume compounding success across genres, geographies, and monetization tools, all of which remain partially unproven. Any narrative cracks, whether from stagnating developer economics, delayed genre wins, or macro pullbacks, risk catalyzing multiple contraction.

TLDR:

Short Roblox (RBLX), -2% weight, ~15% stop loss.

Growth Quality Concerns: While Q1 bookings grew 31% YoY, composition skews toward high-risk markets with uncertain monetization.

Demographic Monetization Gap: Aging-up narrative continues, but high-ARPU behavior in 13+ cohorts remains unproven.

Structural Cost Burden: DevEx, Trust & Safety, and infrastructure needs suppress margin expansion.

Valuation Fragility: The platform still trades on future-state optionality, genre dominance, AI monetization, ad scale, which are early-stage.

Adoption Maturity: Advertising, e-commerce, and payments efficiencies are nascent and not yet needle-moving.

This short thesis expresses skepticism toward Roblox’s ability to sustain premium multiples amid slowing core metrics and unproven expansion levers. The market may continue rewarding bookings growth, but risks to monetization maturity, cost leverage, and narrative control remain asymmetrically tilted to the downside.

These positions are part of our illustrative model portfolio and is presented for informational purposes only. It does not constitute personalized investment advice.

Disclaimer:

Ridire Research is an independent content and research publication affiliated with Ridire Capital Management, a private investment adviser. The materials published herein, including explicit labels such as “Buy,” “Sell,” “Hold,” “Long,” or “Short”, are for general informational and educational purposes only. These views represent the author’s opinion based on publicly available information, internal research frameworks, and market analysis at the time of writing. They are not tailored to the specific investment objectives, financial situation, or risk tolerance of any individual investor.

Ridire Capital Management, its affiliates, and/or employees may hold, trade, or modify positions, long or short, in the securities mentioned, with no obligation to update disclosures or inform readers of changes. Any trade or allocation referenced should be viewed strictly in the context of a model portfolio and not as a solicitation or offer to buy or sell any security.

While all efforts are made to ensure factual accuracy and analytical rigor, no representation or warranty is made regarding the completeness, accuracy, or reliability of the information provided. Readers are urged to perform their own due diligence or consult with a licensed financial advisor before making any investment decisions. Past performance is not indicative of future results. Investing involves risk, including the risk of loss.