High Tide, Higher Margins: Tidewater’s Offshore Supercycle Begins

Scarcity-priced vessels, capital-efficient strategy, and the return of the deepwater cycle.

Tidewater Inc. (NYSE: TDW) remains a high-conviction investment within the offshore energy infrastructure complex. As the preeminent global provider of Offshore Support Vessels (OSVs), Tidewater is leveraging the inflection point in offshore development to assert itself as a disciplined consolidator and cash flow compounder. First-quarter 2025 results reinforce the thesis: TDW delivered superior operational performance, evidenced by record-setting day rates, improved vessel utilization, and over $94 million in free cash flow despite macro headwinds and the seasonal softness typically associated with Q1. Management capitalized on market inefficiencies with ~$100 million in share repurchases, reflecting conviction in intrinsic value.

TDW’s business is underpinned by structural tightness in high-spec OSV supply, regional catalysts (Brazil, West Africa, Asia-Pacific), and sustained oil price strength supporting long-cycle offshore investment. The company’s hybrid strategy, balancing long-term contracts and spot exposure, optimizes for both cash generation and optionality.

Model Portfolio Action: Long

Ticker: $TDW

Model Weighting: 2%

Risk Management Level (Stop Reference): $26.80 (–35% from entry)

Initial Profit Level (Guidance Range): ~$80 and above (+95% from entry), subject to fundamental validation and market context.

This position reflects an allocation within our illustrative model portfolio and is presented for informational purposes only. It does not constitute personalized investment advice.

Financial and Operational Highlights

Revenue: $333.4 million (–3% QoQ) amid Q1 seasonality, yet outperformed internal guidance due to higher day rates and lower-than-expected vessel downtime.

Gross Margin: 50.1% vs. 50.4% in Q4 2024 – two consecutive quarters above the 50% threshold, underlining pricing power and cost discipline.

Adjusted EBITDA: $154.2 million (+11% QoQ), bolstered by FX tailwinds and strong margin management.

Free Cash Flow: $94.7 million – second-highest post-cycle, even after $43.3M in drydock costs and $10.3M in strategic capex.

Figure 1: TDW Price vs FCF per Diluted Share

Source: Bloomberg

Day Rates: Achieved record-high $22,303/day; up +$500/day QoQ. Middle East, APAC, and Americas led sequential rate growth.

Utilization: 78.4% active utilization, up from 77.7% – driven by lower repair days and fewer idle/drydock periods.

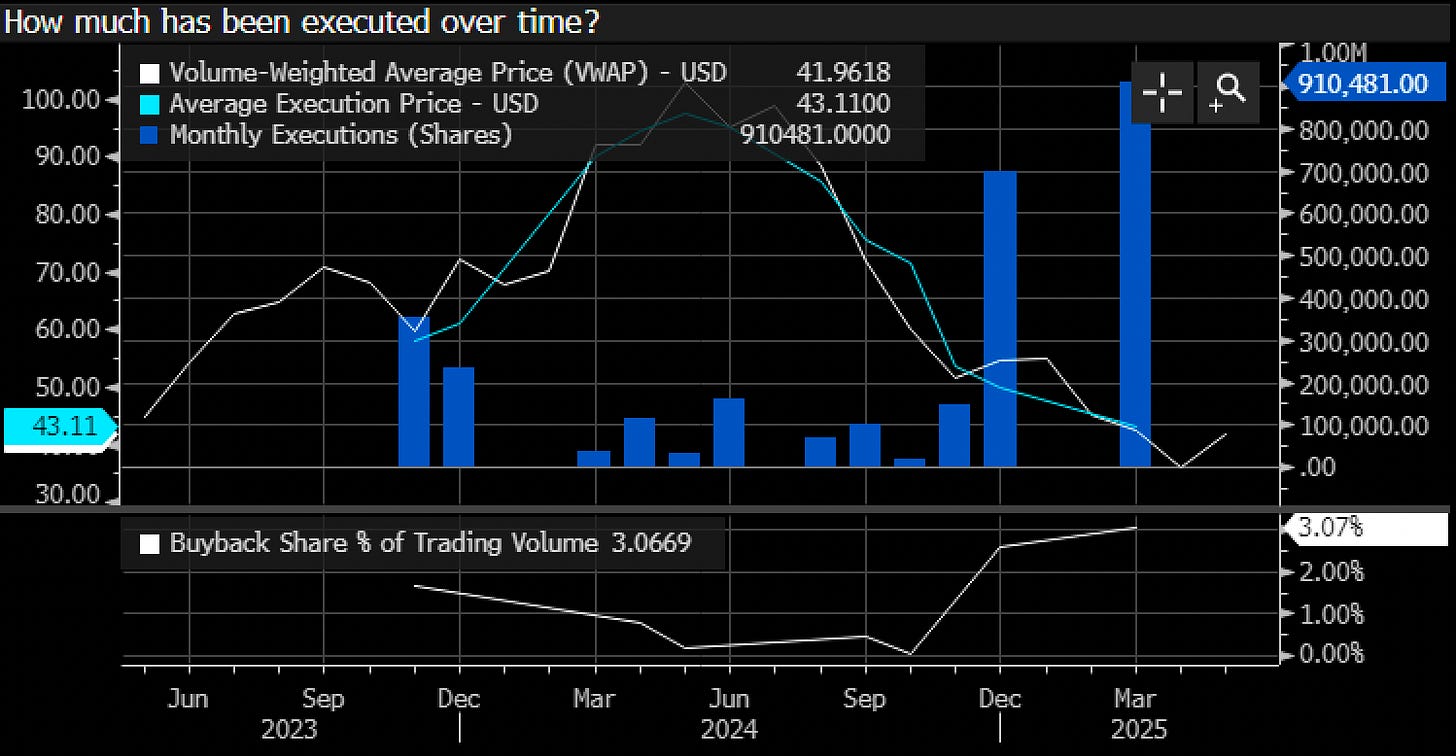

Share Repurchases: $90 million deployed for 2.3M shares; additional 180K shares retired via equity comp tax netting. Total 2.5M share reduction at avg. price ~$39.47.

Figure 2: TDW Share Repurchases

Source: Bloomberg

FY 2025 Guidance Reaffirmed: Revenue of $1.32B to $1.38B and gross margin of 48% to 50%. ~88% of guidance supported by backlog and contract options.

Q2 Revenue Expected: –5% QoQ (seasonal dip, higher idle days).

Q2 Gross Margin: 44% (down from 50% in Q1); anticipated to rebound in H2.

H2 2025: Strong utilization expected; margin uplift from declining drydock and repair days.

Backlog: $848M in firm + option contracts; ~70% of 2025 available days contracted.

Structural Tailwinds Remain Intact

The long-anticipated offshore recovery is transitioning from early-cycle to mid-cycle, with increasing activity in subsea development, FPSO deployment, and multi-year production contracts. This backdrop supports sustained demand for high-spec OSVs, a category where Tidewater holds a meaningful competitive advantage.

Oil Price Resilience: Brent remains above breakeven levels for offshore development. Despite geopolitical and macro volatility, upstream CapEx remains robust.

Limited Newbuild Supply: <3% of global OSV fleet on order; shipyard constraints, financing barriers, and rising build costs act as effective supply caps.

Geographic Rebalancing: Vessels shifting from North Sea to Brazil to chase long-term Petrobras tenders, tightening vessel supply in both regions.

Regional Performance Breakdown

Americas

Brazil: Petrobras released a tender for up to 18 large OSVs, likely pulling vessels from UK/Norwegian North Sea and tightening global supply. Non-Petrobras IOC activity remains strong.

Mexico: PMEX remains in operational disarray; TDW holds $35.1M in receivables with no expected impairment, but no near-term growth.

Suriname & Guyana: Development phase approaching; long-term demand expected to materialize into 2026.

Africa

Orange Basin (Namibia/Congo/Ivory Coast): Active drilling and production campaigns supported strong Q1. Additional tenders expected midyear.

Angola & Nigeria: Long-term tenders for 2026 support backlog extension. Short-term volatility likely, but secular growth remains intact.

Middle East

Tightest Global Market: Persistent under-supply, robust tendering activity post-Ramadan. Both NOCs and contractors driving demand.

Asia-Pacific

Malaysia: Petronas reactivating tenders. APAC margins improved due to vessels shifting from Australia (lower crew costs).

Australia: Major subsea construction campaigns slated for H2 2025 – large AHTS and PSV demand to follow.

Europe & Mediterranean

North Sea: Q1 weakness due to seasonality. Rates flat but remain above prior-cycle levels (2010–2014). Brazil-bound vessels to tighten North Sea market in H2.

Strategic Capital Allocation

TDW completed $90M buyback (max allowed under bond indentures); 2.3M shares retired.

Additional 180K shares net settled against tax obligations.

Management has expressed preference for M&A over buybacks, but repurchases executed opportunistically in face of wide valuation discount.

Existing bonds cap shareholder distributions at 50% of trailing four-quarter net income.

Management evaluating debt refinancing post-July 2025, when call premium on Nordic bonds steps down.

Goal is to transition to long-term unsecured capital structure with revolving credit facility.

Insider Buying

Insider buying activity has notably picked up again.

These recent purchases echo the historical pattern of insider buying at local troughs, such as in 2020 and mid-2022, which preceded significant uptrends.

The renewed insider accumulation reinforces conviction in Tidewater’s valuation reset and signals management’s confidence in the durability of the company’s forward earnings power.

Figure 3: Insider Buy Transactions

Source: Bloomberg

Risks and Watchpoints

Deferred Maintenance: Q1 benefited from lower repair days; deferred maintenance may compress future utilization temporarily.

Geopolitical Shocks: Middle East volatility poses upside and downside risks; demand is strong, but security premiums may fluctuate.

Tariff Regimes: U.S.-led tariff volatility may marginally impact U.S. supplier cost chains.

Receivables: PMEX exposure ($35.1M) warrants monitoring but deemed recoverable.

TLDR:

Tidewater (TDW) remains one of the clearest compounders in the energy infrastructure space. The OSV market is structurally short high-spec vessels, and TDW is extracting pricing power with record day rates, expanding gross margins (>50%), and $94M in Q1 free cash flow, even amid seasonal headwinds. Management opportunistically retired 2.5M shares (~$100M) and reaffirmed full-year guidance with 88% revenue visibility already secured.

Secular tailwinds such as Brazilian tenders, Middle East tightness, and a reawakening Asia-Pacific align with Tidewater’s global footprint and operational leverage. With valuation still misaligned to earnings power and long-cycle offshore capex accelerating, we see a durable setup for upward revisions and multiple expansion.

Model Portfolio Action: Long

Ticker: $TDW

Model Weighting: 2%

Risk Management Level (Stop Reference): $26.80 (–35% from entry)

Initial Profit Level (Guidance Range): ~$80 and above (+95% from entry), subject to fundamental validation and market context.

This position reflects an allocation within our illustrative model portfolio and is presented for informational purposes only. It does not constitute personalized investment advice.

Disclaimer:

Ridire Research is an independent content and research publication affiliated with Ridire Capital Management, a private investment adviser. The materials published herein, including explicit labels such as “Buy,” “Sell,” “Hold,” “Long,” or “Short”, are for general informational and educational purposes only. These views represent the author’s opinion based on publicly available information, internal research frameworks, and market analysis at the time of writing. They are not tailored to the specific investment objectives, financial situation, or risk tolerance of any individual investor.

Ridire Capital Management, its affiliates, and/or employees may hold, trade, or modify positions, long or short, in the securities mentioned, with no obligation to update disclosures or inform readers of changes. Any trade or allocation referenced should be viewed strictly in the context of a model portfolio and not as a solicitation or offer to buy or sell any security.

While all efforts are made to ensure factual accuracy and analytical rigor, no representation or warranty is made regarding the completeness, accuracy, or reliability of the information provided. Readers are urged to perform their own due diligence or consult with a licensed financial advisor before making any investment decisions. Past performance is not indicative of future results. Investing involves risk, including the risk of loss.